36+ how to take over someone's mortgage

300 and a 05 funding fee paid by either the buyer. Web If You Are Taking Over Someones Mortgage Payments Your Documentation Checklist Should Include.

How To Remove A Name From A Joint Mortgage

The loan generally will have to be repaid soon after the borrower.

. Web The only legal way to take over a joint mortgage is to get your exs name off the home loan. You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. Same goes for any co-signer who no longer wants to be on the line for a.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Looking For Conventional Home Loan. Web Apply to assume the loan if it is an FHA or VA mortgage.

Web The maximum allowable fees for FHA and VA loan assumptions are listed below. Pay any closing fees for the assumable mortgage. Web The Bottom Line.

Create your mortgage release contract with our template. Web Up to 25 cash back If your spouse passes away but you didnt sign the promissory note or mortgage for the home federal law clears the way for you to take over the existing mortgage. Compare Lenders And Find Out Which One Suits You Best.

Say you want to sell your home and deed it to another party with that new owner taking over responsibility for repaying. Web In order to take over a loan you need to show that you can make the payments. All Major Categories Covered.

Ad 5 Best Home Loan Lenders Compared Reviewed. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Refinancing to put the mortgage in your own name is a common way to go from co-owner to sole owner.

Ad Is your mortgage fully paid. Web Peter Fox WalletHub Analyst. Looking For Conventional Home Loan.

Find A Lender That Offers Great Service. This means applying for a new mortgage with a new loan. Reverse mortgages cant be transferred from one borrower to another.

Our guided questionnaire will help you create your mortgage release contract in minutes. Ad 5 Best Home Loan Lenders Compared Reviewed. You will typically at least pay for the title.

Compare More Than Just Rates. Web If there is no beneficiary or heir and you would like to take over the mortgage you could reach out to the servicerlender to discuss taking over the. Web Put simply an assumable mortgage is any home loan that allows a new borrower to take over an existing mortgage from the original borrower.

Web Up to 25 cash back Heres how an assumption generally works. The executed legal agreement between you. Compare Lenders And Find Out Which One Suits You Best.

Comparisons Trusted by 55000000. Comparisons Trusted by 55000000. Select Popular Legal Forms Packages of Any Category.

You may go to an FHA- or VA-approved lender and apply to assume the mortgage.

Real Estate Listings For Bill Dignan Williams Realty Partners

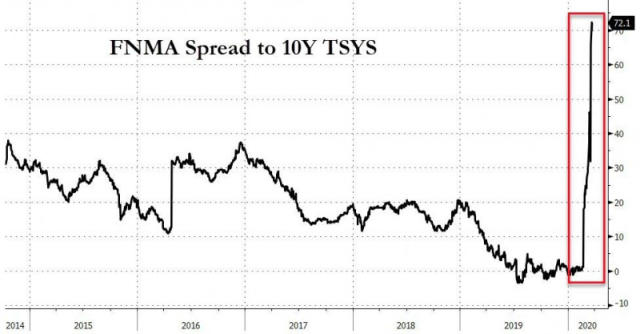

Virus Curve Market Crash And Mortgage Massacre

16206 State Route 301 Lagrange Oh 44050 Mls 4266916 Howard Hanna

How To Take Over Someone Else S Mortgage Legally

Mortgages What Are Your Options What Can Go Wrong Debt Camel

5 Tips For Assuming A Mortgage From A Family Member

1218 36th Ave N Saint Cloud Mn 56303 Realtor Com

Paying Off A Mortgage Early How To Do It And Pros Cons

How Do I Get A Mortgage The New York Times

85 0 Lake Shore Drive Canton Me

Full List Of 116 Synchrony Store Credit Cards 2023

49 Harbor View Drive Stockton Springs Me

Maine Real Estate Listings F O Bailey Real Estate F O Bailey Real Estate

:max_bytes(150000):strip_icc()/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png)

How To Remove A Name From A Mortgage When Allowed

5 Stephenson Lane Belfast Me

Michael Rand Real Estate Broker Mortgage Broker Michael Rand Associates Inc Professional Mortgage Real Estate Services Linkedin

How To Take Over Someone Else S Mortgage Legally Budgeting Money The Nest